How do I set up a Fixed Entitlement Rule?

The following section explains how to set up a fixed entitlement rule. It has been kept intentionally simple. The rule is a 20-day rule that uses standard hours and rate. It can be applied to an employee to pro-rata their holiday allowance using a “contract multiplier"

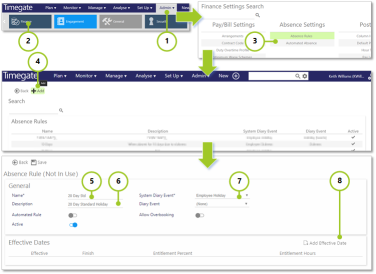

A - Getting Started

-

Select Admin from the main menu

-

Select Finance from the submenu

-

Select Absence Rules

-

Select Add to create a new rule

-

Enter a Name for the rule - 20 Day Std

-

Enter a Description for the rule - Enter 20 Day Standard Holiday

-

Select a System Event e.g. Employee Holiday

-

Select Add Effective Date - this will display more sections on the screen including Entitlement Settings, Carried Forward and Payment Settings as well as those for the Effective Date

B - Entering the Entitlement Settings

-

Select the Entitlement Method - for this walk through use Contracted Multiplier. When configuring a contracted multiplier rule, instead of defining the fixed number of hours or days that an employee is entitled to, you specify a number of weeks’ worth of entitlement that they are allowed. This is typically set at 5.6 weeks.

Against the employee record, you can then specify the number of hours or days per week they work. The employee’s entitlement is then calculated by multiplying the 5.6 weeks by the hours or days (depending on how the rule is set up).

As an example, an employee works 4 days per week. They would therefore be awarded 22.4 days per year (5.6 x 4).

A different employee may work 5 days per week and so would be awarded 28 days per year.

Within the contracted hours section, you can specify Maximum Contracted Paid Hours and Maximum Contracted Days. These restrict the maximum values you can specify against an employee. They have no bearing on the actual calculation of the entitlement

When Derived is selected, as part of the overnight balance processing, the average number of worked days and hours per week, for each employee, is calculated

Instead of then using the fixed values entered against each employee, these calculated values are used instead. This provides a much more accurate way of calculating the entitlement as many employees switch between different work patterns during their holiday year. For example, they may move from a 2 day a week pattern to a 4 day a week pattern. If a Timegate Web user didn’t change their working days on their employee record, then they would be “deprived” of a certain amount of entitlement.

During this set up, the screen will change with Contracted Hours, Carried Forward and Payment Settings displayed. -

Select the Entitlement Type - Select the type of rule - in this walk through, select Fixed. Making this selection will alter settings available lower down the screen

-

Select the Entitlement Unit - Select Hours for this walk through - again you will see the screen values change for the entitlements. There is no need to make any changes to the Carried Forward or Payment Settings

C - Entering the Carried Forward Settings

-

Some companies allow their employees to carry over a certain amount of unused entitlement. This is configured here. As part of the overnight balance processing, when the run date crosses the end of the employee’s entitlement period, a calculation is performed to see what their entitlement was as at that last day and how much they’ve taken in the year. If there is anything left, then that amount (up to the Max Carried Over) is carried forward to the next entitlement period.

-

Select Save, ready to assign to an employee