How do I configure Statutory Sick Pay?

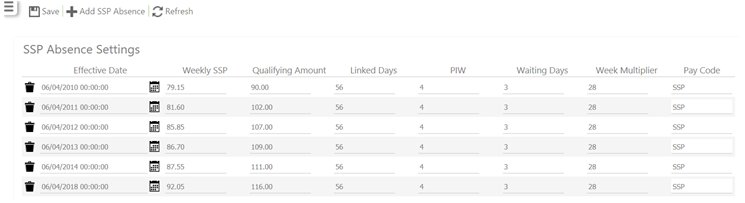

To configure how Statutory Sick Pay (SSP) is calculated, open the Admin | System | System Settings | Absence SSP page. A screen similar to the one shown below will be displayed:

To add a new SSP Absence Setting to calculate how SSP is paid:

-

Select + Add SSP Absence

-

Complete the newly added row at the bottom of the screen (use the guidance below to understand each of the values in the row)

-

Select Save to store your settings. You will be prompted to logout and log back in again to see your changes:

-

Select OK and logout for the change to become operational

The following definitions explain the values in each row:

|

Effective Date |

Date that the SSP rule comes into effect for example 06/04/2020

|

|

Weekly SSP |

The weekly SSP amount in local currency e.g. £95.85 in the UK through tax year 2019-20201

|

|

Qualifying Amount |

Amount to be earned (before tax) before SSP is payable. This is worked out by using the Average Weekly Earnings (AWE)2 in the 8 weeks prior to the sickness being paid for example £120 in the UK through tax year 2019-2020

|

|

Linked Days |

The maximum gap in days, between Sickness Diary Events before the Waiting Days are deducted before a payment is made for example 56 in the UK through tax year 2019-2020

PIWs (see below) are linked and treated as 1 PIW, if the gap between them is 8 weeks (56 days) or less. If all 3 WDs have not been used in the first PIW, use any remaining WDs at the start of the next or series of linked PIWs.

Entitlement to SSP is decided by applying the qualifying conditions to the first day on the first PIW, not the start of any later linked PIW. So if for example, an employee qualifies for SSP in the first PIW, but their earnings fall below the Lower Earnings Limit of £116, entitlement will continue during the second PIW, despite the fall in earnings. Meanwhile, if an employee does not qualify for SSP in a first PIW for any reason, they would not qualify in any later linked PIW3

|

|

PIW |

Period of Incapacity for Work (PIW) - The number of days that the Employee must be ill before SSP is paid. A period of sickness lasting a given number of days or more in a row. In the UK, this is presently 4 days, with all days of sickness counting towards the total number of days in a PIW, including bank holidays, weekends and non working days

|

|

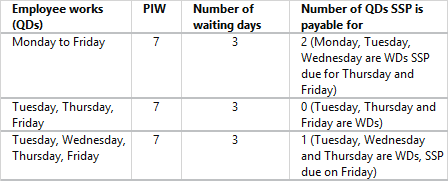

Waiting Days |

SSP is not payable for the first 3 Qualifying Days (QDs)4 in a PIW - these are called Waiting days (WDs). They are not always the first 3 days of the sickness absence as the employee may be sick on non-QDs, for example weekends. In the examples below, the employee is sick for 1 week Monday to Sunday

|

|

Week Multiplier |

The number of weeks that SSP is paid

|

|

Pay Code |

This is used to tell the Payroll system how to classify the payment when sent on an interface

|

Note: The rules above do not include those providing financial support to individuals who cannot work because of Coronavirus (COVID-19)