What do the different values mean when setting up an Absence Rule?

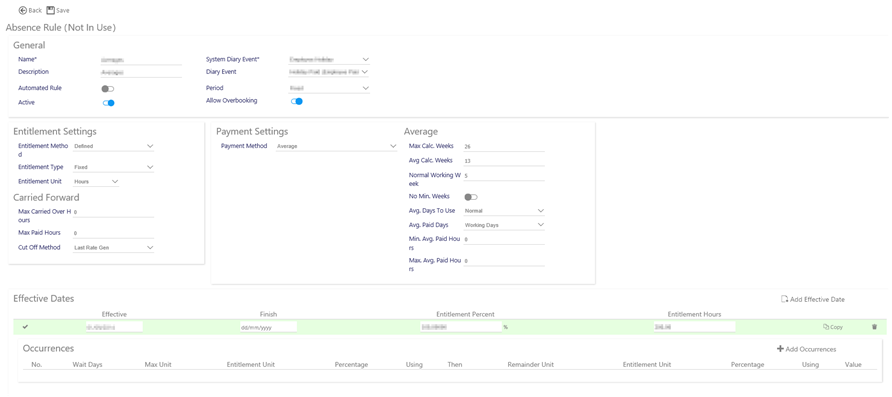

When adding/editing an Absence Rule, a page similar to the following is shown:

The different values on the screen are explained section-by-section below

|

Name |

Name of the Absence Rule

|

|

Description |

Description of the Absence Rule

|

|

Automated Rule |

Select to automatically creating diary events, on a monthly basis to cover any outstanding absence from the previous month

|

|

Active |

By default, will be active and available for use elsewhere in Timegate Web. If made not active in the future, this setting will not remove the rule from Employees that have it assigned or stop it processing - it will simply not show it for future use in Employee | Absence.

|

|

System Diary Event |

There are six different choices to select from here:

There is no processing behind either Injury on Duty or Time Off in Lieu

|

|

Diary Event |

This drop-down list is generally used in conjunction with Absence event types only. It’s not advisable to select anything in here for sickness, holiday or parental absence types. Diary Events are configured from Admin | General | General Maintenance | Diary Events

|

|

Period

|

This setting defines how the holiday year works, from Fixed date for one year, or a Rolling yearly period

|

|

Allow Overbooking

|

This will allow the Employee to take more entitlement than defined but will not be paid for any additional work. Ideally this option should not be selected, with an Un-Paid Holiday Diary Event used instead. It would then be immediately obvious unpaid leave has been taken within the diaries, however, to allow the payment of fractions of Holiday Entitlements then this option should be selected i.e. an employee with a remaining entitlement of 1.6 days holiday should be given an absence duration of 2 paid days – the system will automatically pay 1 whole day and 0.6 of the remaining day

|

|

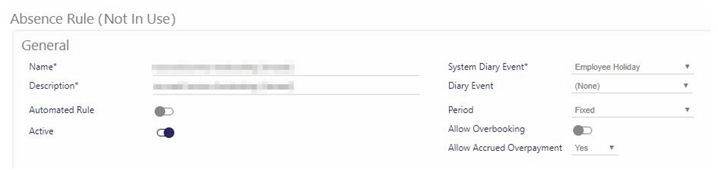

Allow Accrued Over Payment and Months |

This control checks to see whether a diary event can be created when the paid duration of the event exceeds the accrued entitlement.

It is assumed that only whole months will be counted. Therefore, if the employee joined on 1st January 2019 and a diary event was being entered for 25th December 2019, then only 11 whole months would be counted. Only on 1st January 2020 would 12 whole months be counted

|

|

Entitlement Method

|

Select Entitlement Method. Choices are:

Further details of Entitlement Methods are detailed in How are Entitlement Methods Calculated?

|

|

Entitlement Type

|

Select between a Fixed or Service based absence entitlement rule |

|

Entitlement Unit

|

This is the Entitlement Unit (of Measurement). Select from Hour, Day, Incident or Value:

If Accrued rules used, this list will be restricted to Hours and Values

|

|

Per (shown when Incident selected)

|

Select the Entitlement Unit (of Measurement) for the Incident. Select from Hour, Week, Month, Year, period of Employment |

|

Display to the Nearest Half Hour (shown when Hoursselected

|

By default, when an absence rule is configured using hours, hour values are displayed to two decimal places. Select this option to display any hourly fields, rounded up or down to the nearest half an hour. Note: By selecting this option, the no changes are made to the rate generation of absence or any absence calculations. The setting only controls on screen rounding. |

This screen will only be shown for absence rules that are being configured using the Contracted Multiplier Contract Method:

|

Derived

|

Derived using the Calc Weeks,Max Calc Weeks and No Min Weeks |

|

Max. Contracted Paid Hours

|

Select to limit the hours paid to an Employee |

|

Max. Contr. Hours |

This is the maximum number of hours that can be entered in the Contracted Hours field on the Employee Absence Tab. For the Annual Days Cap below to work, the employee needs both this and Max. Contr. Days values populated. Be aware that entering 0 (zero) as a value will result in processing not being undertaken - the system will read this as zero being the maximum contracted hours rather than an unlimited amount of maximum contracted hours. Ensure you enter the correct maximum contracted hours in here. |

|

Max. Contr. Days |

This is the maximum number of days that can be entered in the Contracted Days field on the Employee Absence Tab. For the Annual Days Cap below to work, the employee needs both this and Max. Contr. Hours values populated. Be aware that entering 0 (zero) as a value will result in processing not being undertaken - the system will read this as zero being the maximum contracted days rather than an unlimited amount of maximum contracted days. Ensure you enter the correct maximum contracted days in here.

|

|

Annual Days Cap |

The contracted multiplier Annual Days Cap is to make contracted multiplier rules more re-usable across employees with different contracted hours or working days. It is only visible if the rule is a Contracted Multiplier Rule, and it is Not Derived. This cap is always measured in days, regardless of whether the entitlement is measured in hours or days. For the cap to work, the employee needs both the Max. Contracted hours and Max. working days values populated. Entering the value 0 for either of these values will result in the system not calculating the values - specific values need to be included. The following example for an employee contracted to work 60 hours a week, over 6 days per week, with an absence rule allowing 5.6 weeks annual leave and a rule to cap at 28 days shows how the cap works: Employees Max. Contr Hours = 60 hours Employees Max. Contr. Days = 6 days Entitlement weeks = 5.6 weeks Annual days cap = 28 days

Entitlement = 60 contracted hours x 5.6 weeks = 336 hours Hours per day = 60 contracted hours / 6 working days = 10 hours/day Days equivalent = 336 hours / 10 = 33.6 days 33.6 days is greater than the 28 day cap, so entitlement is capped at 28 days (which at 10 hours per day is 280 hours)

|

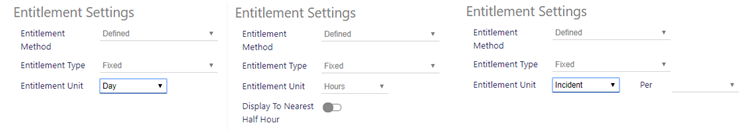

This screen will only be shown for absence rules that are being configured using the Accrued entitlement method rules:

|

Max. Accrued Entitlement

|

This value specifies the longest duration the entitlement will be valid for

|

|

Accrual Period

|

Select between Weekly or Two Weekly. Defines the period that the Max Accrued Period Entitlement cap will be over

|

|

Max. Accrued Period Entitlement

|

If any calculated entitlement exceeds the value in the Max. Accrued Ent. then the hours are capped for that Accrual Period. If the absence rule has a Max Weekly Accrued Ent. value greater than 0, then the accrued calculation will analyze hours worked on an Accrual Period basis and cap the hours if they exceed the value specified against the absence rule. If the new absence rule field is 0, then the existing accrued calculation, albeit, the existing calculation also includes absences that have been ticked

|

|

Accrual Type

|

Select between Work or Time:

|

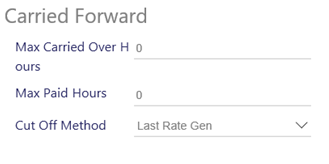

Shown only for fixed period rules that are holiday or TOIL (Time off in Lieu):

|

Max. Carried Over Hours/ Carried Over Values/ Carried Over Days/ Carried Over Incidents

|

Enter a limit for the amount of Hours, Values, Days or Incidents that can be carried over. A numeric value from 0 (the default value) upwards that determines how much absence entitlement can be carried over to the next entitlement period. for example if 5 days were left and this value was set to 3 then only 3 days will be carried to the next period - any more than the Max Carried Over Hours/Values/Days/Incidents will be lost

|

|

Max Paid Hours/Paid Values/Paid Days/Paid Incidents

|

Enter a limit for the Paid Hours, Paid Values, Paid Days or Paid Incidents paid to an Employee |

|

Cut Off Method

|

This indicates the point where the balance processing is carried out. This is to allow for all of the Diary Events to be reviewed and corrected before balance processing is done. There are three options to select from the drop-down list:

|

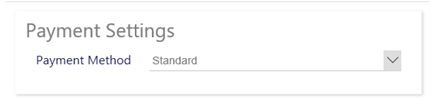

This setting is not shown for Time Off In Lieu (TOIL):

|

Payment Method

|

The method of payment for the rule. This can be any of the Hour and Rate Calculations as listed:

For more information see How are hours and rates calculated for different payment methods in rules?

Note: Contacted Hours/Average Composite Rate rule is based loosely on the existing average hours and rate calculation, but there are some subtle, but quite significant differences that have been requested by one Timegate Web customer

|

|

Max Calc. Week (Daily Hours)

|

Maximum Weeks For Daily Hours Calculations - Used to calculate average daily hours. The maximum number of full weeks that Timegate Web will look back to obtain the number of information defined below in the Avg Calc. Weeks (Daily Hours) field. In line with UK Legislation this value is recommended to be between 52 and 104.

|

|

Avg Calc. Weeks (Daily Hours)

|

Average Weeks For Daily Hours Calculations - Used to calculate average daily hours. - The number of Full Weeks needed to get an average for payment (daily hours). If there is a week where no payments are made the system will look back to the Maximum number of weeks to get the information (as defined above in Max Calc. Weeks (Daily Hours))

|

|

Max Calc. Weeks (Hourly Rate)

|

Maximum Weeks For Average Hourly Rate Calculations - Used to calculate average daily rate. The maximum number of full weeks that Timegate Web will look back to obtain the number of Average Weeks information defined below in the Avg Calc. Weeks (Hourly Rate) (Hourly Rate Calculation). This value is often left at 12 (in line with the UK Governments old guidelines, ensuring employees average hourly rates become accurate more quickly)

|

|

Avg Calc. Week (Hourly Rate)

|

Average Weeks For Average Hourly Rate Calculations - Used to calculate average daily rate. The number of Full Weeks to get an average for payment. If there is a week where no payments are made the system will look back to the Max Calc. Weeks (Hourly Rate) to get the information required (Hourly Rate Calculation)

Note: Due to UK legislation changes that took effect from April 2020, the calculation of average daily hours and average hourly rates is now based upon a minimum of the last 52 weeks, up to 140 weeks. An employee’s calculated average hourly rate would have been adversely affected by this if they had a pay increase recently i.e. within the past 52 weeks. This would not have been reflected in the pay they received for a diary event fully until after 52 weeks. The way that has been resolved is by introducing the Max Calc. Weeks (Hourly Rate) and Avg Calc. Weeks (Hourly Rate) alongside the Max Calc. Weeks (Daily Hours) and Avg Calc. Weeks (Daily Hours). By splitting the number of weeks for the average calculation out in such a way that the number of weeks of data used to calculate the average daily hours can continue to use the UK Government guidance, and the number of weeks used to calculate the average hourly rate can be less, the employee will be more rapidly see the benefits of their pay increase when calculating averages. |

|

Normal Working Week

|

The number of days per week used to derive the average hours for the employee

|

|

No Min. Week

|

Select to limit the minimum weeks paid to an Employee

|

|

Avg. Days To Use

|

From the drop-down list, select:

|

|

Avg. Paid Days

|

From the drop-down list, select:

|

|

Min. Avg. Paid Hours

|

Select to limit the minimum hours paid to an Employee

|

|

Max. Avg. Paid Hours

|

Select to limit the maximum hours paid to an Employee

|

|

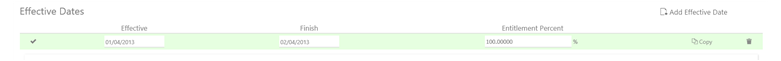

Effective

|

Enter the effective start date (be that through manual, keyboard entry in the local date format from language settings format or by using the drop down calendar)

|

|

Finish

|

Enter the effective finish date (be that through manual, keyboard entry in DD/MM/YYYY format or by using the drop down calendar)

|

|

Entitlement Percent

|

Amount of Entitlement Hours, Values, Days, Incident, or Weeks within a period expressed as a percentage |

|

Entitlement (Units - Hours / Values / Days/ Incidents / Weeks)

|

Amount of Entitlement Units (be that Hours, Values, Days, Incident, or Weeks entitlement for contracted hours / composite rate payment method)

|

|

BH Entitlement (Units - Hours / Values / Days/ Incidents / Weeks)

|

Amount of Bank Holiday Entitlement Units (be that Hours, Values, Days, Incident, or Weeks entitlement for contracted hours / composite rate payment method). BH Entitlement Weeks, for example indicates how many weeks of the overall entitlement are bank holidays. For example, in the UK under current legislation, an employee with a minimum entitlement would have an absence rule with a contracted Entitlement Weeks of 5.6. In turn, this would mean that the BH Entitlement Weeks would be 1.6. This means that an employee who works 5 days per week would receive 28 days holiday per annum (5.6 * 5) of which 8 days (1.6 * 5) would be made up of bank holidays. |

|

No. |

Number of the occurrences

|

|

Wait Days |

Days that are not paid at the start of the Diary Event (the amount of days before the allowance becomes payable) i.e. in the case of SSP, none is paid for the first three days of any illness, An employee would have to wait three days for this payment to commence

|

|

Max Unit |

This value is used to cap the amount of payments made per week based on the entitlement unit below

|

|

Entitlement Unit |

The unit of measure, for example, Blank, Hours, Days. This value cannot be days or hours. Cannot be days if main method is hours. |

|

Percentage |

The percentage of the gross payment calculated to be paid to the employee |

|

Using |

Defaults to the Rule Using Field and cannot be changed |

|

Then |

For the remainder of the entitlement defined, the system will pay the following:

If this is left blank, it does not apply remainder calculation

|

|

Remainder Unit |

The remaining entitlement

|

|

Entitlement Unit |

Defaults to the Entitlement Unit and cannot be changed

|

|

Percentage |

The percentage of the gross payment calculated to be paid

|

|

Using |

Defaults to the Rule Using Field and cannot be changed

|

|

Value |

Physical Value to pay

|

TIP: Several of the screen areas above will only be displayed if certain settings, indicated above are selected. If a value is not required for a certain configuration of an Absence Rule, it is not visible on the screen. This removes any confusion for the user when they are entering their details. It also ensures only the necessary details need be entered.